I. Business overview.

Mader Group is an Australian provider of contract labour for maintenance of heavy mobile equipment in the resources industry (mining, primarily), offering a variety of services:

Maintenance labour.

Field support (site labour with support vehicles and tools).

Shutdown teams for major overhauls.

Maintenance workshops and training of teams.

Ancillary services.

Founded in 2005 by Luke Mader (current Executive Director and owner of c.57.0% of the total shares outstanding), the group is headquartered in Perth (Australia) and, as of FY2022 (ending in June), employs more than 2,200 people, a fleet of 900 service vehicles and carries its operations in 9 countries:

Australia.

USA.

Laos.

Mauritania.

Mongolia.

Papua New Guinea.

Philippines.

Zambia.

Canada (since early 2022).

It is worth mentioning that the group was present in 11 countries during FY2020, but due to COVID-19 lockdowns and travelling restrictions the company decided to step back and halt its operations in 4 of them from Africa, Asia and South America, focusing instead on its two major markets: Australia and USA.

This brought the amount of countries with active operations down to 7 by the end of FY2021.

As related restrictions ease progressively, the group is stepping back into these markets and resuming operations with existing partners.

The company’s sales are diversified across clients, locations and sectors within the resources industry, servicing maintenance in over 480 locations for 350 different clients.

In 2019 Mader entered the USA market, and it has turned out to be a jewel in the operations of the company. It took roughly 18 months for this segment to become profitable, but nowadays (as of Q1 FY2023) it contributes to the c.25.0% of total sales.

Mader is a business that does not require external capital to operate, being financed with its own equity -which leads to high returns on capital-.

The relatively low capital intensity of the group has enabled the payment of dividends at the same time as achieving growth. Very selected businesses can afford such a privilege.

Two new organic startups were founded in FY2022: Mader Energy and Mader Canada.

The latter represents the business unit designated after the group started operations in the Canadian market in the early months of the year, which is considered to have an even greater TAM than its US counterpart.

In regards to management, Luke Mader (founder) is still at the helm of the company as one of the Executive Directors, keeping ownership of roughly 57.0% of the total amount of shares outstanding.

I found the story of Luke interesting, working as a tradesperson and marketing employee at Caterpillar the preceding years to 2005 (when he decided to create Mader).

II. Sector.

Although small (as of November 2022 Mader’s market capitalisation stands at A$700.0M), the group is the biggest player in its niche worldwide.

The rationale behind this is that the maintenance activities associated to heavy mobile equipment have been historically executed by the manufacturers themselves (similar to what Kone, OTIS or Schindler do in the elevators and escalators industry).

Mader’s business model puts forward a lower cost for customers than that of the original manufacturers.

After few days trying to find any peer or direct competitor I have failed loudly: the only ones I was able to spot are the maintenance departments within manufacturing companies like Caterpillar, Hitachi, Komatsu, Volvo, etc. or small, local labour houses.

The main difference between the aforementioned “peers” and Mader’s business model is that the latter is the only one offering field maintenance -which is more convenient for the customer, given the costs associated to (a) transportation and (b) time consumption in carrying this type of machinery to a specialised workshop-.

The industry is currently a highly fragmented sector where Mader’s business model is expected to continue to flourish organically (as it has been the case since its foundation 17 years ago).

III. Financials.

Since 2018, Mader Group has increased its revenues by 109.0% (a 20.2% CAGR), with overall gross margins in the range of [19.0, 21.0]%, operating margins of c.9.0% and NPAT margins of c.6.5%.

By FY2022, the business reported A$405.0M in sales, A$43.5M in operating income and A$31.1M in NPAT.

Cash from operations are typically higher than bottom line, mainly due to depreciation costs associated to strong investments in expanding its service vehicles fleet to support future growth.

There are wide variations in the profitability of its different markets, which responds to administrative expenses (mainly labour costs) representing the biggest cost for the company.

According to the company reports, three main segments are distinguished:

Australia.

USA.

Other international markets.

The Australian operations are the pivoting angle for the enterprise, where it initiated its operations and proved its business model.

Nowadays, Mader is using its Australian branch as a sandbox where new ancillary services are offered and tested with existing and new customers, verifying how the customer base reacts to them and the overall added value brought to the client’s operations.

As of FY2022, the Australian segment contributes A$345.3M (85.3%) to total sales, growing at a fast pace (25.9% year over year).

Profitability in this segment lies around 9.9% and 7.1% for EBIT and bottom line margins, respectively.

As mentioned earlier, the group initiated its operations in the US market during FY2019.

This segment has materialised as a hidden jewel in the company operations, growing from A$13.8M in sales in FY2020 to A$50.1M by FY2022 (53.7% CAGR).

The US operations contribute, as of FY2022, 12.4% of total revenues and show a higher profitability than the Australian segment (14.9% EBIT margins).

As it is expected, margins are nonetheless compressing at a relatively fast pace, down from 22.7% the prior year as Mader increases its American headcount.

The “Other international markets” comprise the operations in various countries from Africa, Asia and South America.

After the COVID-19 outbreak in the end of FY2020 (fiscal year ends in June), the company decided to halt its operations in four out of the eleven countries where it was present. In recent quarters, Mader has started to ramp up business activities with existing customers in these areas.

As of FY2022, this segment contributes A$9.6M (2.4%) to total sales, down from a A$27.1M (11.8%) contribution in FY2019. The decrease in weight is not only attributable to the drop in revenue but also to the rapid growth experienced by the other segments (specially the North American market).

Operating margins in these international branches more than double those of the other segments, reaching 21.2% in FY2022.

The group is conservatively financed, with a net debt of A$26.7M (net debt to EBIT ratio of x0.76) although, due to the small size of the company, banks tend to lend money at higher interest rates than usual. As the enterprise grows and proves its ability to generate cash, these rates should come down to more reasonable levels.

In fact, new financial liabilities in FY2022 bore a weighted average interest rate of c.4.0%, down from c.6.5% in FY2019.

Interest expenses and EBIT amounted to A$1.4M and A$35.1M in FY2022, setting an interest coverage of 25 times, roughly.

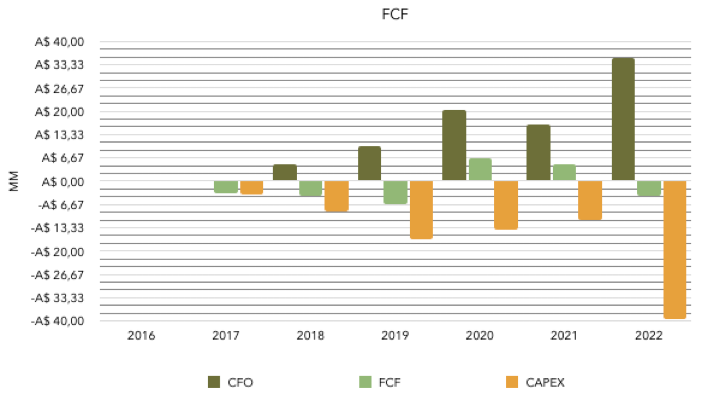

Mader is a highly cash generative business, usually converting to net cash from operations more than reported in the bottom line, primarily driven by depreciations of substantial expenses in expanding the service vehicle fleet in FY2019 (A$13.6M) and FY2022 (A$31.0M) to enable future growth of its operations.

These represent 81.6% and 80.8% of total capital expenditures, respectively. Consequently, free cash flow was negative both years.

From FY2019 annual statement we can deduce that the average price of each service vehicle is around US$36,000.

Last-minute update:

On October 25, Mader Group just announced its results for the first quarter of FY2023:

Revenue increased 48.0% year over year, primarily driven by the increase in sales in both Australia (34.0%) and USA (202.0%).

The guidance for FY2023 has been increased from A$510.0M in sales and A$33.0M in NPAT to, at least, A$550.0M and A$35.5M, respectively.

The US segment continues to gain relevance rapidly, weighting 19.4% of total revenues (versus 12.3% in FY2022).

A somewhat concerning point is flat sales on the “Other international markets” segment. Although the zero COVID-19 policies adopted in most Asian countries are causing pandemic-related restrictions to persist. This is a topic worth to keep an eye on.

IV. Management.

Skin in the game is probably the single most important factor that I look for when studying a business, this is, a substantially higher portion of the management’s net worth being invested in the company (at risk). This creates a symbiotic relationship between the executive directors and the common shareholder which reduces conflicts of interest and forces the former group to create value for the latter one in their own quest for wealth.

Luke Mader, a former tradesperson at WesTrac (Caterpillar dealer) and marketing employee at Caterpillar itself, discovered an underserviced niche in the industry and decided to start Mader in 2005.

He is still present in the daily activities of the company as an owner-operator, keeping more than 113 million shares (circa 57.0% of the total outstanding pool).

Justin Nuich has been the CEO since 2021 (replacing Patrick Conway), previously working at senior roles for more than 20 years in the mining and resources industry at companies like Fortescue Metals, Mineral Resources and BHP.

As of FY2022 end, the total amount of shares held by Justin amounted to 3.3 million (fully diluted), or c.1.5% of the total pool.

Patrick Conway, former CEO and CFO of the company, continues to be an Executive Director and has been part of Mader since 2014.

Craig Burton, current Non-Executive Director and a former venture capital investor, is the second largest shareholder of the group, owning 39 million of shares outstanding (circa 19.0% of the company).

Remuneration.

There are three main elements in the remuneration of the executive committee:

Fixed pay.

STI (Short-Term Incentive) plan.

LTI (Long-Term Incentive) plan.

The fixed pay component is primarily consisted of cash, although it may also include superannuations and other non-financial benefits (provision of motor vehicles, mobile phones or computers).

The amount varies depending on the degree of skill, experience and qualifications relating to each particular role.

In the case of Luke Mader, his fixed remuneration amounts to A$2,000 per day worked, whilst for other Executive Directors it ranges between A$250,000 and A$500,000 per year.

Short-term incentives take the form of a cash bonus which is paid following the end of the financial year and are determined by performance metrics as follows:

Economic profit’s alignment to growth in shareholder’s wealth. No specific target.

The ratio defined as TRIFR (Total Recordable Injury Frequency Rate) being less than 5 incidents per million hours worked.

Long-term incentives take the form of a 2-year equity incentive plan which can result in the gain of either performance rights or SAR (Share Appreciation Rights) according to a predefined set of goals as listed:

FY2024 Performance Rights:

Mader Group generates A$40.0M in NPAT.FY2026 Performance Rights:

Mader Group generates A$60.0M in NPAT.SAR:

Each KMP (Key Managerial Personnel) to continue employment by 30 June 2024.

As of FY2022, the total remuneration received by each KMP is shown below:

Luke Mader: A$216,000.

Justin Nuich: A$1,681,824.

Patrick Conway: A$1,150,914.

Craig Burton: A$66,000.

V. Thoughts.

Qualitative analysis.

There are gems among the dust too. Sectors with bad unit economics or high cyclicality do not consist uniquely of cyclical businesses. There can always be niche markets or sub-industries with great tailwinds, isolated from the harsh reality faced by other companies in the same environment.

A prime example are the engine manufacturers in the airlines sector, where motors are sold at cost and revenue is -very profitably- made on the maintenance contracts which follow.

I believe Mader belongs to such group.

Revenue growth is primarily driven by three factors:

Increase in demand in regions where the group already operates (both existing and new clients).

Expansion to new addressable markets where the usage of heavy mobile equipment is significant.

Addition of new ancillary services which are complementary and value add services to the core capabilities of the business.

Factors (1) and (3) are, in my view, closely related: the increase in demand from existing customers is driven by the value added (lower cost than the traditional offering) and the quality and effectiveness of Mader’s services, but also by the introduction of new ancillary services which complement the main offerings in the company’s portfolio.

The group is currently using the Australian market as a sandbox for new services, introducing them to existing and new customers in a phased manner by its Ancillary Division (launched in FY2015). These range from supply complementary mechanical to hard rock equipment maintenance activities.

In regards to factor (2), the immersion into the US market in FY2019 and its subsequent development is more than just an overseas expansion of the business. It represents a proof of the dominance that the core business model posed by Mader does not only relate to Australia but it holds its strength in other developed countries.

The spectacular growth and rapid turn into profitability of the US segment opens the possibility to confidently access new potential markets, like has been the case with the creation of the Mader Canada startup in January 2022.

According to the company’s reports, the Canadian market puts forward an even bigger addressable market than the traditional US one:

Not only that, but the customer concentration is also much higher: by partnering with only 3 clients in Canada, Mader Group is engaging in c.15.0% of the mining locations in the country (this compares to a 2.0% sites engagement via 40+ customers in USA).

While customer concentration can be seen as a risk (and it surely is), if properly executed it also entails a potentially more rapid growth and expansion as the reputation is built faster.

Arguably, the single most important competitive advantage that a business in any sector may have is a strong enterprise culture.

The inclusion of the TRIFR ratio as part of the STI performance goals tells much about how Mader’s management is committed to preserve the safety of their employees. It is this type of details by which strong company cultures are spotted.

Reputation and scale play an important role in the sector. As the company scales its operations, its reputation should follow and, in turn, create a virtuous cycle where they fuel each other.

Points to keep an eye on.

There is a variety of topics which I consider worth being keen on for the coming years. Most notably:

The evolution of the African, Asian and South American operations.

The development of the two new branches created in FY2022: Mader Energy and Mader Canada.

Capital expenditures.

The segment categorised as “Other international markets” comprises the group’s operations in countries like Chile, Mauritania, Mongolia, Laos, Papua New Guinea, Philippines and Zambia. It is also, by far, the most profitable one with operating margins of 21.3% (compared to 9.9% for Australia or 14.9% for the US).

The opportunity of ramping up operations in these markets represents a great way push margins up and create value for the common shareholder.

At the beginning of FY2022, the company stated that it was starting to progressively re-enter these niche sectors by establishing again contracts lost with existing customers in these areas after the pandemic’s outbreak.

FY2022 turned out to be a great period for Mader Group, with the founding of two organic startups: the Mader Energy division and the Mader Canada branch.

Mader Energy was born to address a new potential market: the resources industry associated to the extraction of fossil fuels, rather than metal mining.

The creation of the Mader Canada division represented the opening door to a new market: the Canadian resources and mining industry.

The size of its TAM is estimated to be almost double than that of the US, and three times the Australian one.

I feel particularly interested in monitoring whether the Canadian segment behaves in a similar fashion as the US has done so far.

Finally, although not extremely concerning, I believe it is somewhat relevant to keep an eye on the capital expenditures of the group. The purchase of service vehicles is needed to support future growth, but every second year it is eating the netted cash-flows from operations in its entirety.

The table below shows the relationship, in A$ millions, between OCF, CAPEX and FCF for the last years:

VI. Valuation.

What is a reasonable price to pay for a fast-growing, relatively asset-light business with high returns on capital employed (ROCE in the range of 30.0%)?

hi Ben - code is mad.as and not max.ax :-) HNY23!