Last year I started sharing my activity in the financial markets in an attempt to fulfil a double purpose goal: (a) public transparency should help me in including an additional isolation layer from the emotional side of investing (by reducing unnecessary activity) and (b) putting in place another tool to force me to write down the thoughts and rationale behind certain decisions.

I feel happy to see that so far it has been extremely instrumental and hope this continues to be the case for many years.

Performance.

The portfolio returned +12.35% last month (+12.39% at c.c.).

This compares to a +5.19% (+6.43% at c.c.) for the S&P500 non-financials (SPXN) over the same period.

Since inception in January 2022, the total return has been +7.34% (+8.52% at c.c.).

This compares to a -9.35% (-14.02% at c.c.) for the SPXN over the same period.

Contributors.

The top contributors to market performance last month were Meta Platforms (+2.84%), Temenos (+1.99%) and Mader Group (+1.45%). On the other hand, the top detractors to market performance were Water Intelligence (-0.74%), O’Reilly Automotive (-0.34%) and ZIGExN (-0.18%).

Since inception, the top historical performers have been ASML (+52.49%), LVMH (+37.62%) and Games Workshop (+32.30%), whereas the top under performers have been Meta Platforms (-19.67%), Temenos (-19.29%) and Water Intelligence (-11.38%).

Activity.

January 2023 has been a somewhat active period, more than I would like to admit. Here’s the list of transactions that took place during the month:

Stake in Temenos was increased by 6.38%.

After carefully considering the situation of the Japanese yen (highest inflation in the last 42 years in a prolonged zero-rates environment), the position in ZIGExN was terminated. Nothing wrong with the business, it was a hard decision to make as I foresee many years of double-digit sustainable growth for the company. It is a matter of a potential permanent devaluation of the JPY compared to EUR.

Part of the ZIGExN proceeds were utilised for initiating a new position in a (mostly) American business I’ve been studying for some time and for which I am preparing a write-up at the minute: Water Intelligence.

In the stock market it is always a confession of mistake whenever we sell. I find these to be the saddest when there is nothing fundamentally wrong with the business being sold.

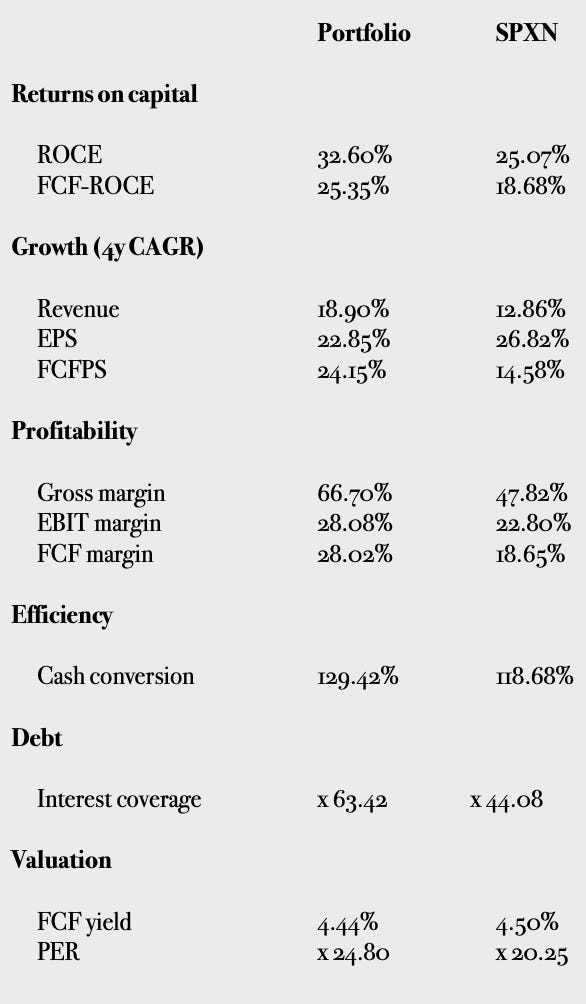

Look-through metrics.

A comparative analysis of market performance with the applicable benchmark may be beneficial but, in my view, draws similarities to focusing on what the output of a black-box system looks like while ignoring the inputs being processed.

In investing, all that matters at the end of the day is the outcome of a process (market returns), that’s true, but it is our work as investors to attempt to understand the mechanisms which are at work behind the curtain. The primary reason why I compare my portfolio to a benchmark from a qualitative and financial standpoint (SPXN) responds to the idea that if we own businesses growing faster than average, being more profitable, with more opportunities to reinvest excess earnings at high rates of return and at similar or even lower valuations, the output of the black box will outperform the average over sufficiently long periods of time.

The table below provides a comparison of some metrics I consider of interest between a weighted calculation of the portfolio versus the relevant index.

Unless otherwise stated, values are LTM.

Content consumed during the month.

As of this month, I will start including some references to what I consider the best-quality content I have consumed during the period in an attempt to keep track of curated matters I am focusing on in a more often fashion than in yearly ricapitolari.

Articles:

Hurdle rates & return Lollapalooza, by Tristan Waine from the Professional Value newsletter.

Constellation Software KPI insights, by Simon Handrahan from the Margin of Safety Investing newsletter.

Are you wired for wealth? (Jason Zweig).

Books:

100 to 1 in the stock market (Thomas W. Phelps).

The psychology of money (Morgan Housel). Re-read.

Sites:

An interesting app which enables us to write down customised notes of our investment decisions. It is especially interesting from an emotional perspective, by recording how I feel on any particular occasion about investment ideas.