Commentary.

I’d like to wish you a happy new year. May 2024 be a period of wellness and joy for all of you.

A few of the companies being followed gave a preliminary view of their operations during the past month:

Games Workshop announced EPS growth for the first half of fiscal 2024 of 6.9% and a dividend of £1.2 per share to be distributed in February. The company keeps thriving as expected, rewarding shareholders with high cash-on-cash returns.

Towards the end of the month, ASML reported net bookings in excess of US$9,000.0M (the highest quarterly data to date), ending the year with a flat order backlog and an increase in value of the underlying business of 41.7%. Fiscal 2024 is anticipated to be a period of investments in capacity, resuming growth as of fiscal 2025.

Mader published a press release with a preliminary update on its operations throughout the first six months of fiscal 2024, growing sales by 32.9% and per-share profits by 38.0%. Net debt was reduced substantially and management indicated their intention to turn it negative in the medium term. The audited financials are expected to be published on February 19th.

Performance.

Notes:

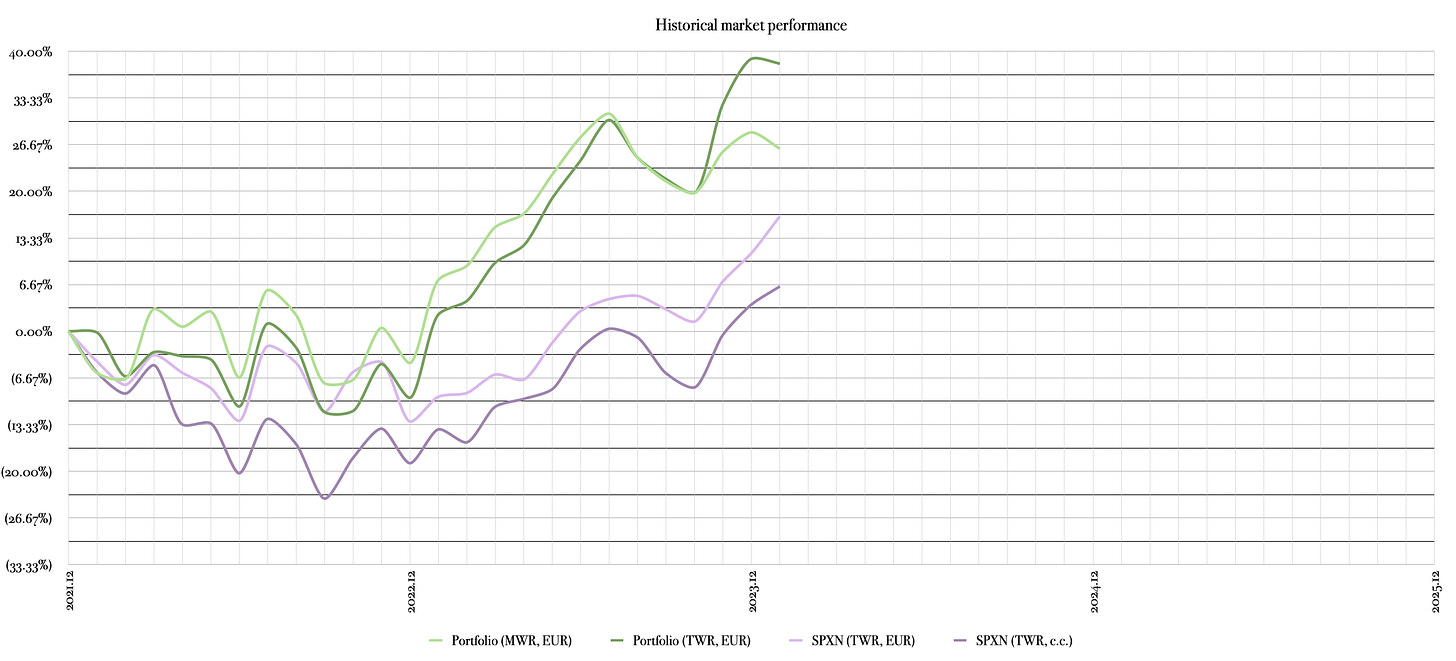

Performance is measured following the money-weighed return (MWR) methodology.

Unless otherwise indicated, performance values are expressed in EUR terms.

The market quotation of the portfolio decreased by -0.4% in January, leaving the year-to-date performance at the same figure and at 26.1% since inception in January 2022 (12.3% annualised).

Comparatively, the S&P500 ex-financials (SPXN) had a great start of the year, returning 4.7% in January and 16.4% since January 2022 (7.9% annualised).

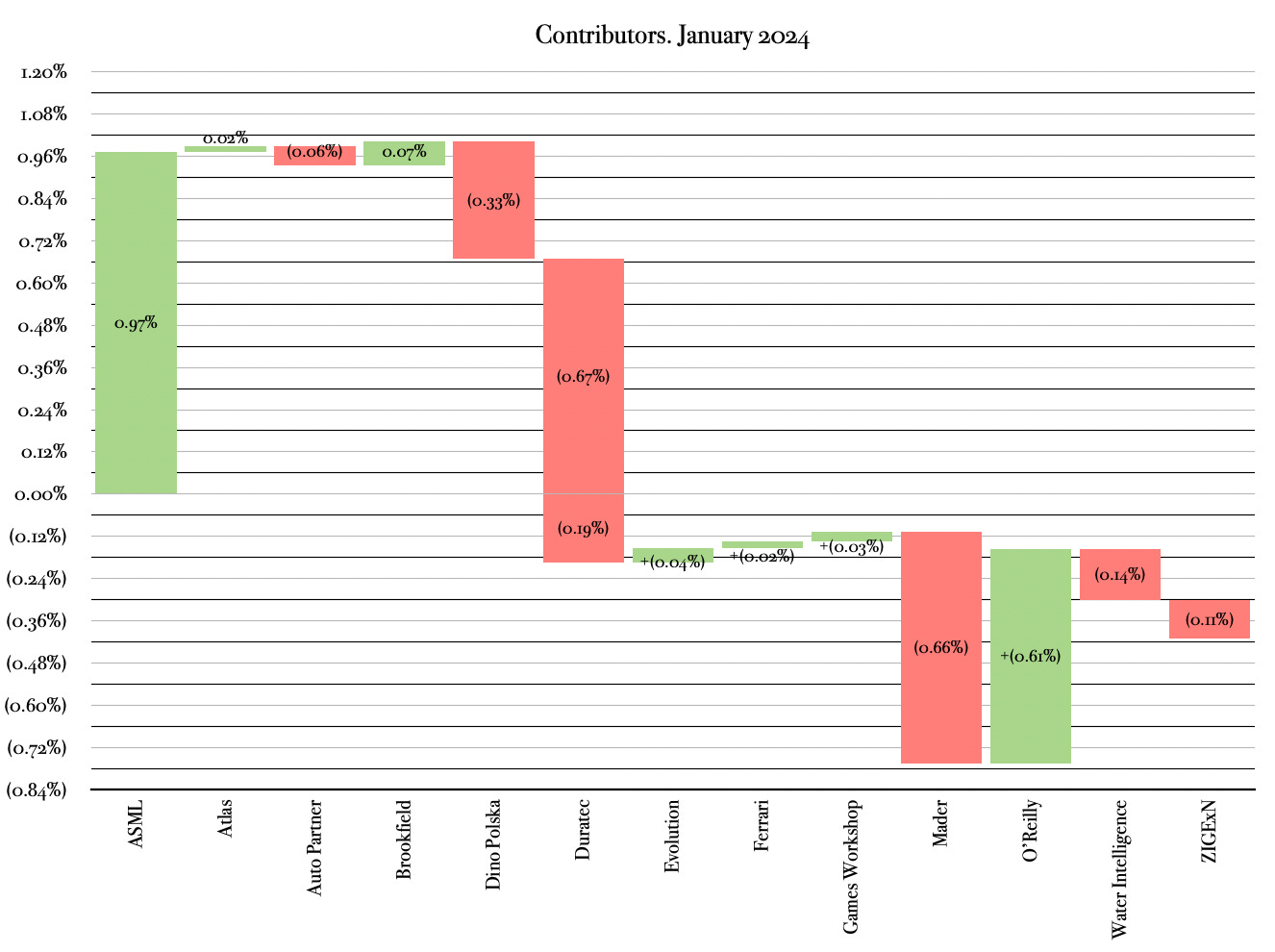

Contributors.

The following table shows the top contributors and detractors to market performance on a weighted basis and converted to EUR during different time frames: last month, year to date (YTD) and inception to date (ITD):

The waterfall charts below are included for a more detailed breakdown of the individual contribution of each holding:

Activity.

A new position was initiated in Atlas Engineered Products. Although small, it is one of the main designers and manufacturers of on-demand wooden assemblies (roof and floor trusses, as well as wall panels) in Canada. The increasing difference between new inhabitants (mostly from immigration) and affordable houses available in the market is pressing the industry to fill the gap over the next decade, for which it is estimated that around 3.0M units will be needed by 2030.

Content consumed during the period.

Some curated content whose read was enjoyable last month:

Books:

El porvenir del viejo mundo (Óscar Vara).

Outliers (Malcom Gladwell).

Same as ever (Morgan Housel).

The great crash 1929 (John K. Galbraith).