As 2023 Q1 has already elapsed, I would like to make the most of this ricapitolare and share some thoughts on significant events during the first three months of the year.

As you may notice in the Contributors section, Facebook’s parent company has accounted for a big chunk of the returns this year, delivering a +72.70% return since January 1st, 2023. Although fairly priced at current levels (in my opinion), there is still long-term potential for value creation through incremental ARPU and WhatsApp monetization, so it is likely that it will continue to be in portfolio for as many years as Zuck continues to execute. Nonetheless, a reduction in size is likely to happen in coming months.

In January, Gustavo (@MexicanInvestor in Twitter) recommended me to check the Twitter account that goes by the nickname of @AbrilQuim and what a great advice it was. Quim is a wonderful communicator with extensive experience in analysing small and medium capitalisation businesses through a KPI-based approach. It was thanks to him that I discovered Water Intelligence, a sewage and water-leak servicing business which derives c.90.0% of its revenues from its US subsidiary (American Leak Detection). I was preparing an entry covering it but I saw there were other high-quality posts already out there, so I decided to keep it private (if you are interested in the company, I recommend the post from Óscar linked in the section Content consumed during the period).

Probably worth mentioning is how Temenos is resuming new ACV expansion after some top-tier banks delayed the signing of contracts in FY2022 Q3. The company experienced subscription growth again in the fourth quarter, continuing its transition to a subscription-based pricing model for the on-premise offerings. In the last month, the scandals concerning the banking sector (SVB, Signature, Credit Suisse…) have not helped its market quotation, so we are seeing it again at what I consider to be attractive levels.

Performance.

Returns came at +5.28% in March (+6.30% at c.c.), leaving the year-to-date performance at +19.51% (+19.90% at c.c.).

This compares to a +2.89% (+6.05% at c.c.) for the S&P500 non-financials (SPXN) over the same period, leaving its year-to-date performance at +7.57% (+9.96% at c.c.).

Since inception in January 2022, the total return has been +14.89% (+16.70% at c.c.), which annualised corresponds to +11.74% p.a. (or +13.15% p.a. at constant currency).

This compares to a -6.18% (-10.77% at c.c.) for the SPXN over the same period, which annualised corresponds to -4.98% p.a. (or -8.71% p.a. at constant currency).

Note:

Performance is measured following the money-weighed return (MWRR) methodology.

Contributors.

The top contributors to market performance last month were Meta Platforms (+2.50%), Adobe (+1.21%) and ASML (+0.59%). On the other hand, the top detractors to market performance were Temenos (-0.70%), Water Intelligence (-0.67%) and O’Reilly (-0.03%).

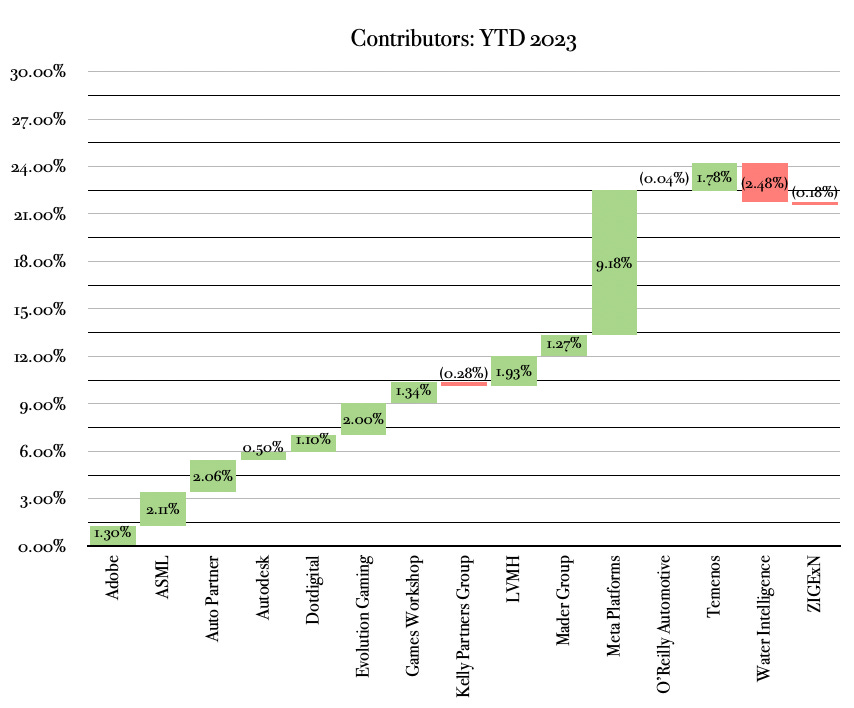

Year to date, the top contributors to market performance have been Meta Platforms (+9.18%), ASML (+2.11%) and Auto Partner (+2.06%), with Water Intelligence (-2.48%), Kelly Partners Group (-0.28%) and ZIGExN (-0.18%) as the main detractors.

Since inception, the top historical performers have been ASML (+51.87%), LVMH (+45.17%) and Evolution (+38.81%), whereas the top under performers have been Water Intelligence (-25.55%), Temenos (-20.03%) and Adobe (+1.11%).

Activity.

There were no outright sales or purchases during the period.

Look-through metrics.

As usual, the condensed list of financial metrics I consider of special interest is included below, as well as how these compare to the corresponding weighted average ratios for the S&P500 non-financials (SPXN) index.

Unless otherwise stated, values are LTM.

Content consumed during the period.

Articles:

Water Intelligence (Óscar 100%).

Books:

The Dhandho investor (Mohnish Pabrai).

Thanks for sharing my WATR post! :)