Performance.

Returns came at +1.54% in February (+0.87% at c.c.), leaving the year-to-date performance at +14.55% (+13.82% at c.c.).

This compares to a +0.59% (-2.14% at c.c.) for the S&P500 non-financials (SPXN) over the same period, leaving its year-to-date performance at +4.48% (+3.68% at c.c.).

Since inception in January 2022, the total return has been +9.36% (+9.05% at c.c.).

This compares to a -8.78% (-15.86% at c.c.) for the SPXN over the same period.

Contributors.

The top contributors to market performance last month were Meta Platforms (+2.94%), Auto Partner (+0.82%) and Evolution (+0.63%). On the other hand, the top detractors to market performance were Water Intelligence (-0.82%), Adobe (-0.73%) and Mader Group (-0.43%).

Year to date, the top contributors to market performance have been Meta Platforms (+6.16%), Temenos (+2.62%) and Auto Partner (+1.64%), with Water Intelligence (-1.67%), Kelly Partners Group (-0.32%) and ZIGExN (-0.18%) as the main detractors.

Since inception, the top historical performers have been ASML (+41.91%), O’Reilly Automotive (+36.84%) and LVMH (+35.74%), whereas the top under performers have been Water Intelligence (-19.95%), Temenos (-14.02%) and Adobe (-12.81%).

Activity.

Stakes in Adobe, Auto Partner and Water Intelligence were increased by 25.0%, 28.57% and 33.33%, respectively.

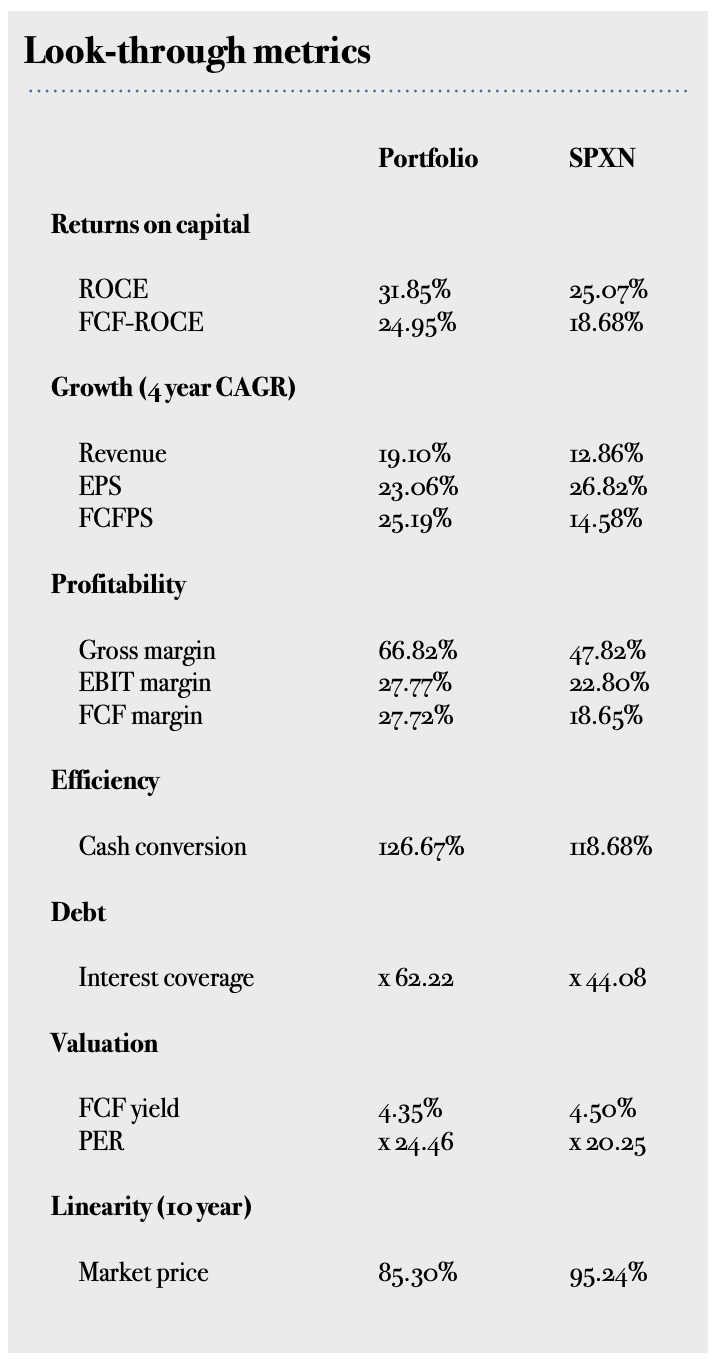

Look-through metrics.

As usual, the condensed list of financial metrics I consider of special interest is included below, as well as how these compare to the corresponding weighted average ratios for the S&P500 non-financials (SPXN) index.

Unless otherwise stated, values are LTM.

You may notice that, as of this month, weighted average linearity of the market price for the last 10 years is included. I got this idea from The Intelligent Quality Investor text, from Long Equity. It is a nice, one hour read with a special focus on what takes to be a great company.

Content consumed during the month.

Articles:

PEGY ratio - The golden ratio, by Tristan Waine from the Professional Value newsletter.

I am an eager reader of anything Tristan puts out there. If you do not follow his newsletter yet, I strongly recommend it.The Lindy effect and antifragility, by Leandro from the Best Anchor Stocks newsletter.

Did you beat the market? (Jason Zweig).

Books:

The art of learning (Josh Waitzkin).

The intelligent quality investor (Long Equity).

Great write up (as always)!