Commentary.

You might have noticed that earlier this year I stopped sharing monthly “ricapitolari”. There is a couple of reasons for this. In my view, these updates are most useful when spread over longer periods such as twice a year or annually. Simultaneously, the purchase of a house and the work that follows it have filled much of my personal time in recent months and my availability for writing here has decreased proportionally.

In general terms, our companies have continued to operate pleasingly in the first half of the year, increasing their aggregated intrinsic value by 18.1% over the past twelve months, which is in line with our long-term annual objective of 15.0% to 20.0%.

Performance.

Notes:

Performance is measured following the money-weighed return (TWR) methodology.

Unless otherwise indicated, performance values are expressed in EUR terms.

The market quotation of the portfolio increased by 5.6% in the first half of the year, leaving the performance since inception in January 2022 at 46.3% (17.1% annualised).

Comparatively, the S&P 500 appreciated 18.8% in the first six months of the year and 28.7% since January 2022 (11.0% annualised).

A small but interesting addition to these updates is the evolution of the aggregated owner’s earnings of our companies in the chart above (dotted black line). Over long periods of time, increases in the underlying value of the companies we invest in (for which we use the concept of owner’s earnings as a proxy) should be in line with the market returns we enjoy (light green line).

Contributors.

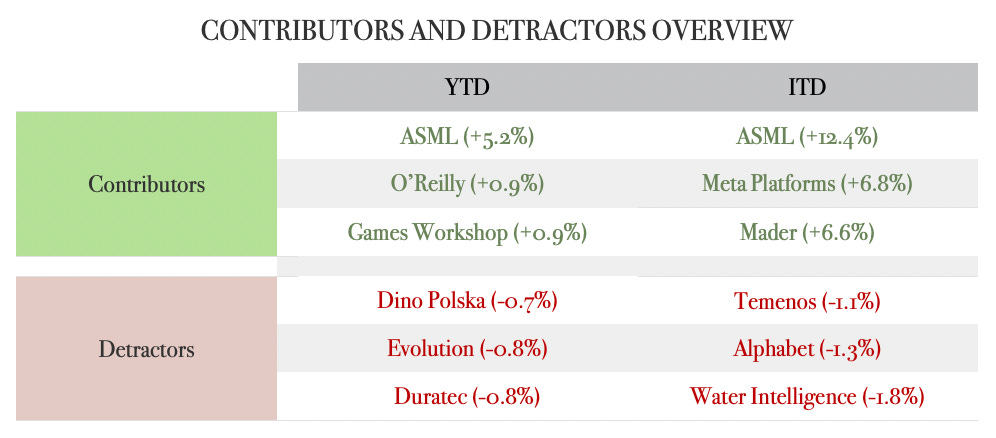

The following table shows the top contributors and detractors to market performance on a weighted basis and converted to euro during different time frames: year to date (YTD) and inception to date (ITD):

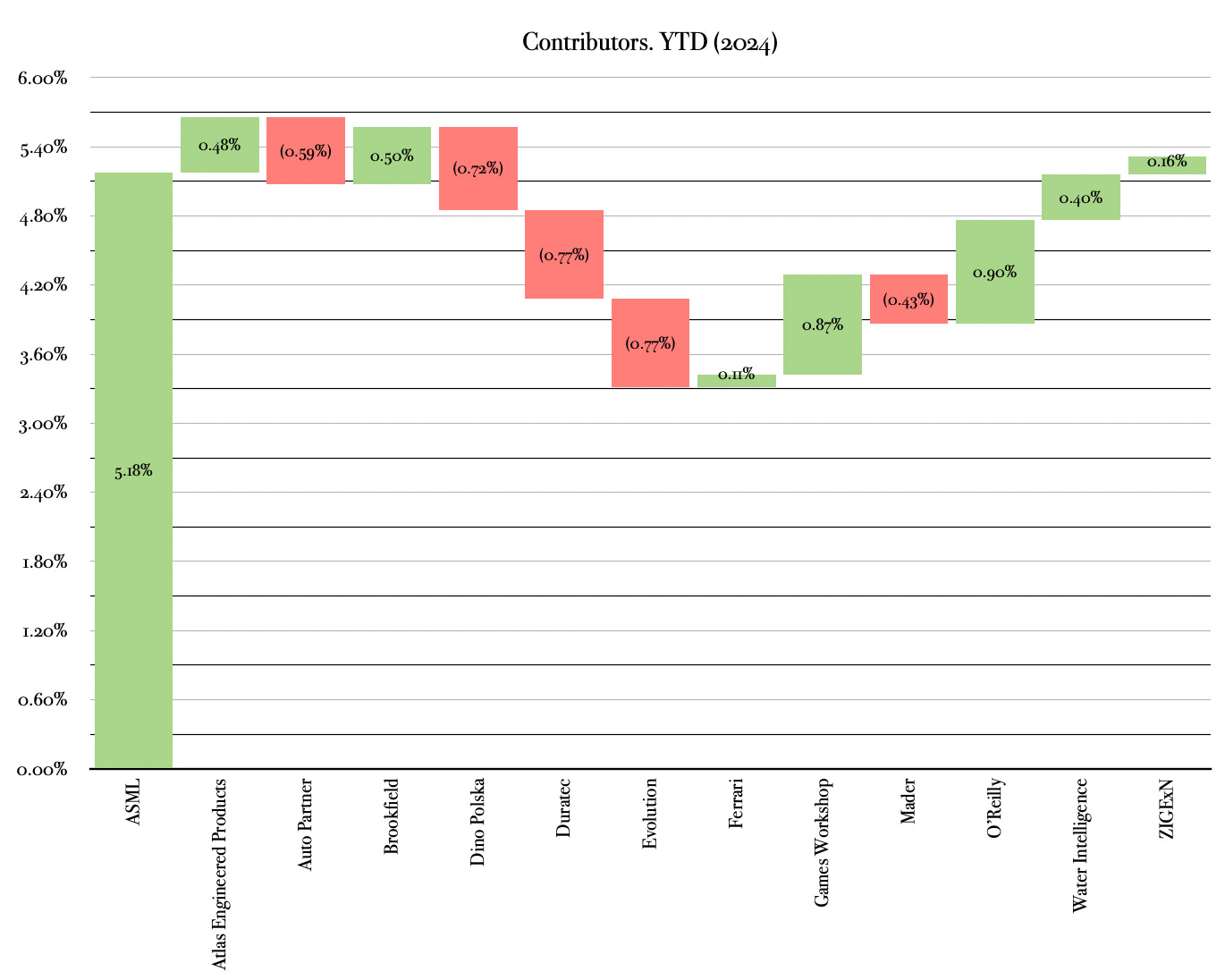

The waterfall charts below are included for a more detailed breakdown of the individual contribution of each holding:

Most of the returns this year have clustered around our position in ASML. Not only its market quotation has increased by 45.9% since the start of the year, but the SBC and other LTIs I participate in have further accentuated the returns, yielding 50.3% in the first half of fiscal 2024. This has resulted in ASML becoming our biggest position, accounting for roughly one fifth of the portfolio’s asset value.

Activity.

There have been no outright purchases or sales during the period.