Commentary.

The first half of the year has been characterised by a market frenzy surrounding artificial intelligence. We addressed this topic last month due to the termination of CentralNic and Dotdigital stakes after displaying too much emphasis on AI activities without ever having mentioned this topic before.

While it is true that AI-led increases in productivity (if confirmed) may overrule a potential recession, the market seems to be overly optimistic with some of these companies and valuations are starting to appear certainly risky in the technology sector. To provide an example, Nvidia’s total market capitalisation just passed the US$1.0 trillion in early June with a consensus of US$40.0 billion in sales for FY2024. That’s 25 times sales after having grown its top-line by c.50.0% in the coming 18 months -if achieved-. Certainly, Nvidia will need to maintain extremely good growth rates in a sustained way over many years to justify current valuations.

Similarly -although to a lower extent-, some holdings in portfolio have also experienced a significant appreciation in value while being considered part of the AI theatre. The primary example is Adobe and its generative AI model (Firefly) which is trading at 32 times adjusted EPS for FY2023. Nonetheless, stock-based compensation accounts for virtually all adjustments made to GAAP EPS so a more realistic measure would be closer to 45 times earnings. Substantially more expensive than right after the Figma’s announcement at the end of last year (when it traded around 25 times statutory earnings per share). Although I usually feel reluctant to sell the ownership portion in a great business like that of Adobe based on pure valuation, at these levels I consider the risk of experiencing multiple compression to be strong. This, combined with the need of some cash in anticipation to a big investment of a private nature has led me to exit the position.

Among the 14 companies we have an ownership in, 5 of them belong to the technology sector and trade at an average valuation of 26.4 times earnings or 3.3% free cash flow yield. The remaining 9 holdings trade, on average, at a PER of 18.3 or 5.1% free cash flow yield.

The owner’s earnings of the companies in portfolio, as an aggregate, have grown by +9.6% in the last twelve months. Over long periods of time, stock market retuns pose a strikingly strong correlation with the behavior of the underlying earnings -in per share terms- of the businesses they represent.

The main detractors in owner’s earnings growth, as discussed in the annual letter at the beginning of the year, are Meta Platforms and Temenos. The former one has taken the first steps towards a leaner structure with a focus on cost control and Temenos’ shift to a subscription-based pricing scheme seems to have bottommed cash flows already.

Performance.

Notes:

Performance is measured following the money-weighed return (MWR) methodology.

Unless otherwise indicated, all performance values are expressed in EUR terms.

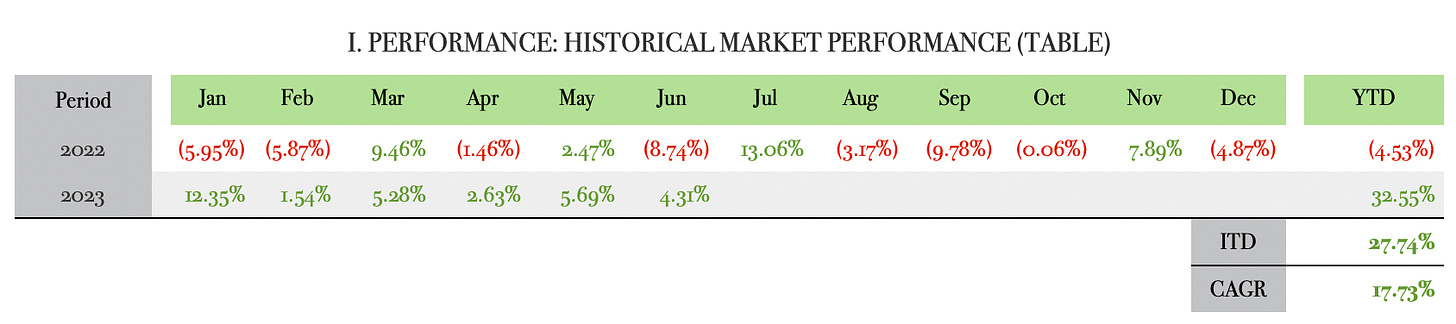

The market quotation of the portfolio increased by +4.31% in June, leaving the year-to-date performance at +32.55%.

This compares to a +4.63% for the S&P500 non-financials (SPXN) last month and +17.49% since the start of the year.

ITD:

Since inception in January 2022, the total return has been +27.74% or an annualised rate of +17.73%.

This compares to a +2.90% for the SPXN over the same period or +0.02% in annualised terms.

Contributors.

The following table shows the top contributors and detractors to market performance on a weighted basis and converted to EUR during different time frames: last month, year to date (YTD) and inception to date (ITD):

The waterfall charts below are included for a more detailed breakdown of the individual contribution of each holding:

Activity.

A rebalancing of the portfolio took place last month via an outright sale of the Adobe position and a reduction of Meta Platforms’ stake by 40.0%. The proceedings were used to increase the stake in Brookfield and to initiate a position in Toya, a Polish micro-cap enterprise that I’ve been following for a while. In my view, there is nothing wrong with Adobe nor with Meta Platform’s underlying business. This decision follows as a consequence of an evolving style towards small-sized companies and a decrease in the overall exposure to the blue-chip technology companies, which I consider to be trading at a big premium nowadays. Complementarily, part of the Adobe proceedings will be kept as cash to cover other expenses of a private nature.

Thanks! I dont get your calculation on YTD return. Can you explain e.g on Meta? +14,6% while it is up +130%? is it a weighted calculation?

great read! - looking forward to see how leaning towards the smaller companies will go! ☺️