Commentary.

I am pleased to announce that, as of this ricapitolare, the performance calculations shown in the Contributors section below are executed in accordance with MWR principles, becoming consistent with the overall reported performance of the portfolio.

In previous reports these were based on TWR due to its relative simplicity.

Performance.

Notes:

Performance is measured following the money-weighed return (MWR) methodology.

Unless otherwise indicated, performance values are expressed in EUR terms.

The market quotation of the portfolio decreased by -3.73% in August, leaving the year-to-date performance at +33.15%.

This compares to a +0.43% for the S&P500 non-financials (SPXN) last month and +20.24% since the start of the year.

ITD:

Since inception in January 2022, the total return has been +24.79% or an annualised rate of +14.21%.

This compares to a +5.06% for the SPXN over the same period or +3.00% in annualised terms.

Contributors.

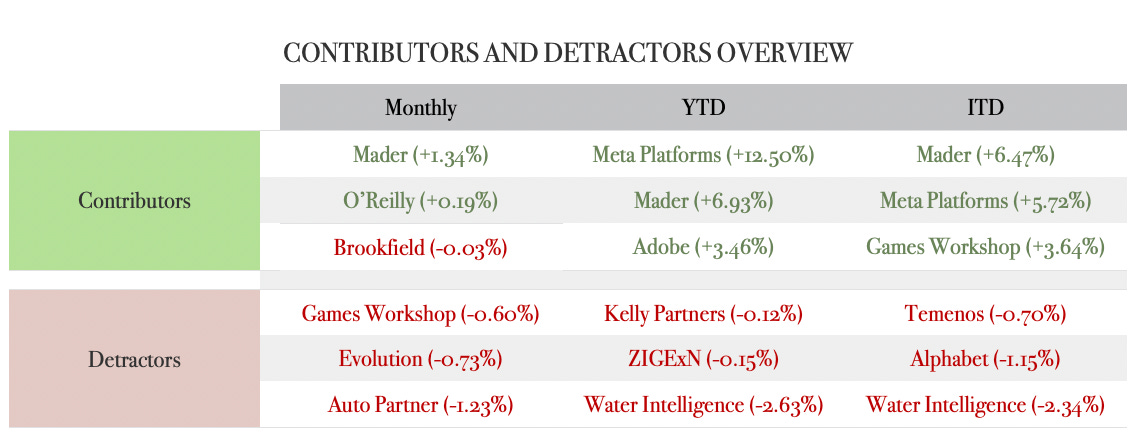

The following table shows the top contributors and detractors to market performance on a weighted basis and converted to EUR during different time frames: last month, year to date (YTD) and inception to date (ITD):

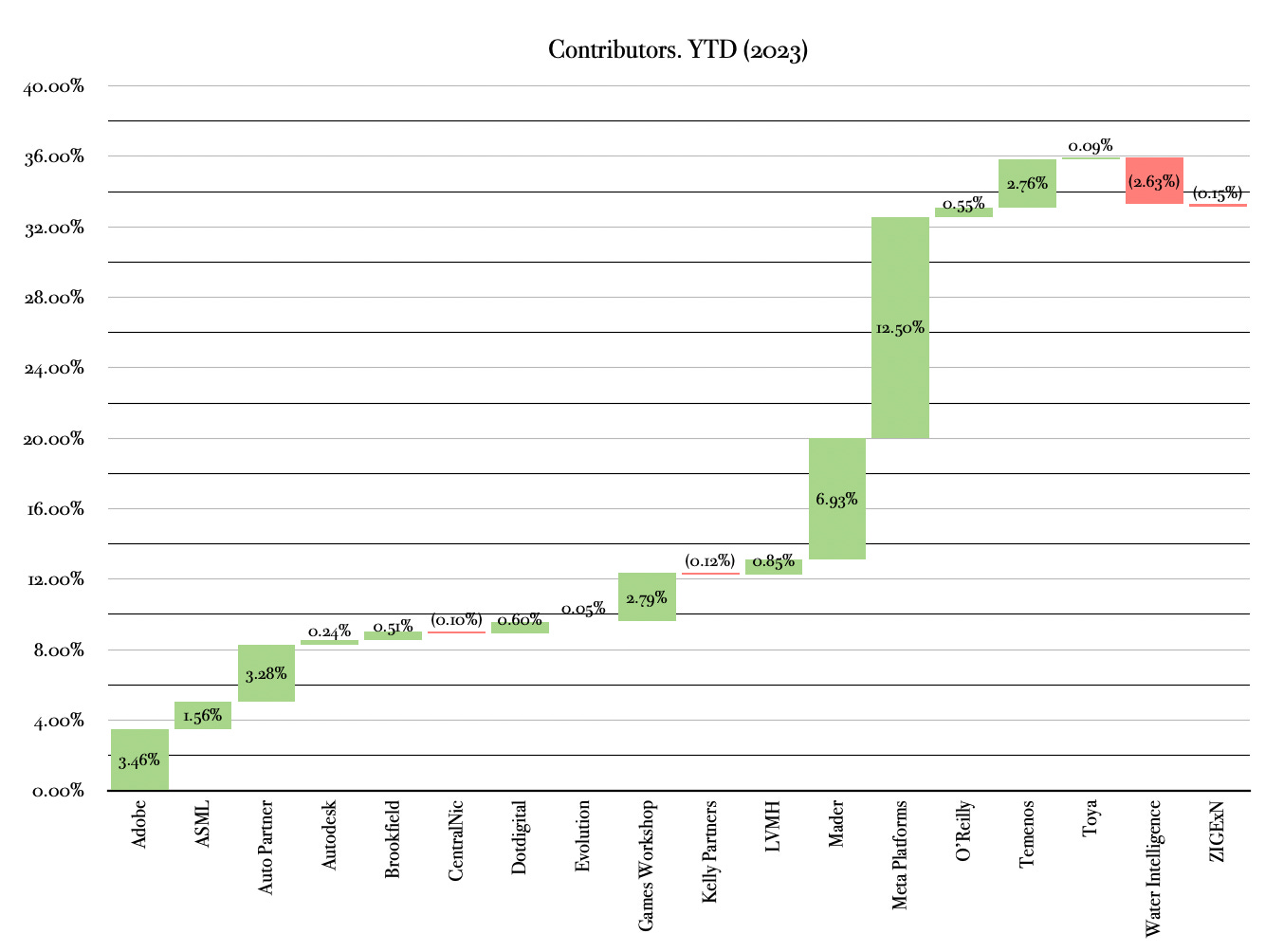

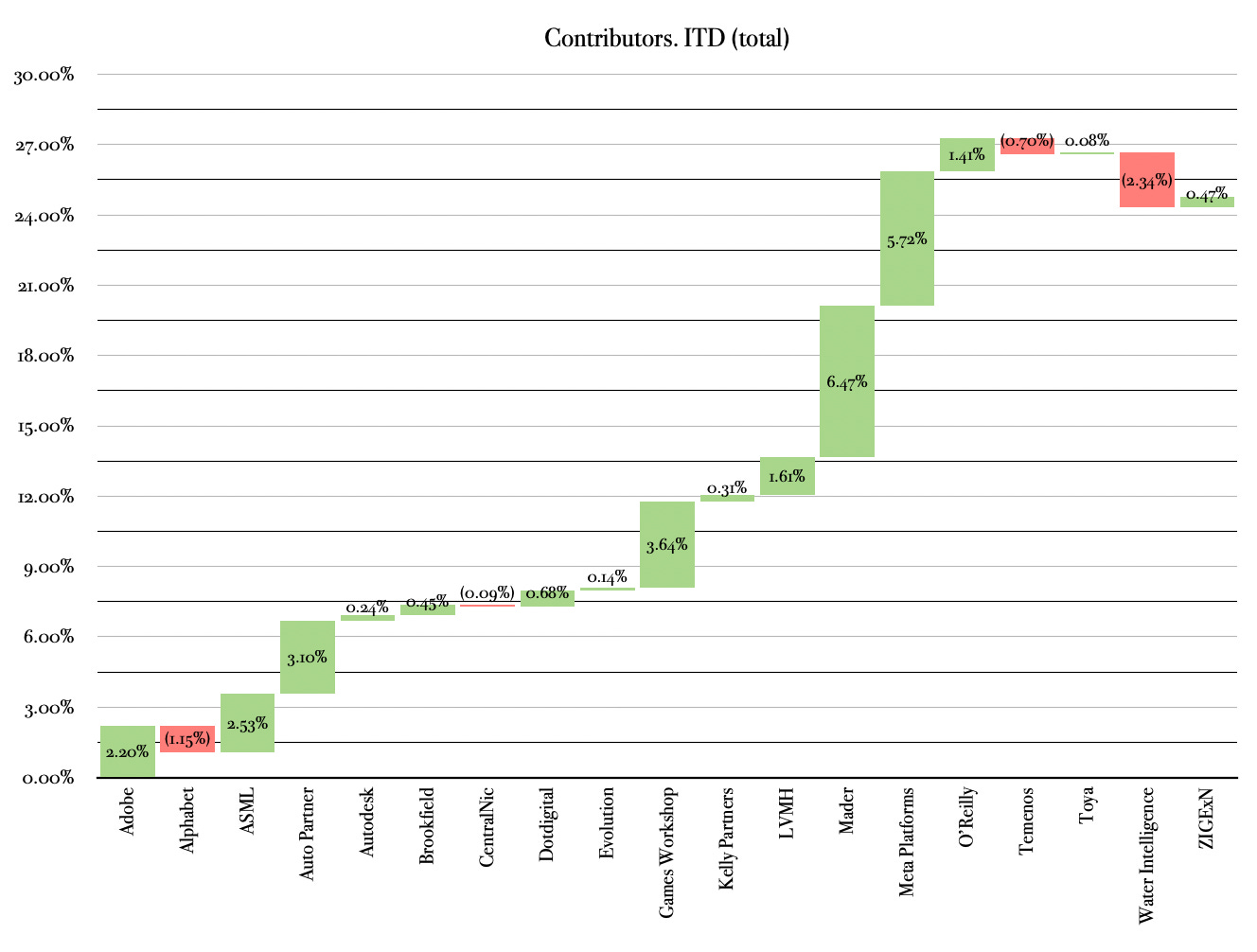

The waterfall charts below are included for a more detailed breakdown of the individual contribution of each holding:

Activity.

Autodesk’s position was exited in full.

The stake in Evolution was increased by 33.3%. After the recent decrease in market quotation by c.20.0% it has entered again the range where I start to consider it attractive: below c.20.0 times earnings (a PEGY shy of 0.7).