I. Business overview.

Wirtek is a micro-cap (c.US$15.0M as of November 2022), IT outsourcing services provider founded in 2001 by Michael Aaen (current CEO and owner of c.30.0% of the total shares outstanding). The company is headquartered in Aalborg (Denmark).

With a headcount of 185 employees working in two office spaces in Denmark and four development centres in Romania, the business operates in various Western countries:

Denmark.

Netherlands.

USA.

United Kingdom.

Germany.

Romania.

As of Q3 FY2022, the international operations of the company accounted for 50.0% of total sales (up from 29.0% the previous year), primarily driven by customers in the Netherlands (c.23.0%) and the US (c.18.0%).

Born as a Nokia’s spin-off in 2001, Wirtek operates two main business units:

Software engineering services:

End-to-end software solutions to match specific customer’s needs such as product (re)engineering, system architecture and design and software assurance.

Revenue growth in FY2021 was 71.0% YoY and, as of Q3 FY2022, this segment accounts for 72.0% of total sales.

Electronic equipment services:

Set of services on the customer’s existing electronic equipment such as embedded and integration software development, as well as quality assurance and conformance testing of the final product.

Revenue growth in FY2021 was 49.0% YoY and, as of Q3 FY2022, this segment accounts for the remaining 28.0%.

At the beginning of FY2020 Wirtek announced its Accelerate25 strategy, aimed to achieve DKK100.0M in revenue and DKK10.0M in pre-tax earnings by the end of FY2025.

From FY2020 levels, this implied a c.30.0% CAGR in sales moving on, to be achieved either organically or via acquisitions.

After experiencing a 64.2% revenue growth and an increase in profitability in FY2021 (operating margins came at c.12.0% compared to an average of c.6.0% in previous years), the management board updated the strategic plan of the company with more ambitious goals. This new strategy is what Wirtek refers to as Accelerate25XL.

Accelerate25XL targets DKK130.0M in sales and DKK15.0M in pre-tax income by FY2025 (an increase of 50.0% from the levels set by its predecessor).

In FY2021, only 18.0% of the 64.2% revenue growth was organic. The remaining increase in sales had to do with the acquisition of CoreBuild (an IT-servicing business located in Cluj, Romania) in April 2021. After the successful merger, approximately 50 employees joined Wirtek.

With this M&A, Wirtek’s services and customer’s portfolio expanded significantly into other Western countries like the Netherlands, USA, Germany or Romania.

In September 2021, the company announced the first order within the cybersecurity IT services space coming from an existing customer from the US, followed by the first order from the UK market the very next month.

As in other engineering services companies, the single biggest expense for the company is employee wages, averaging DKK147.000/year gross salary in FY2021.

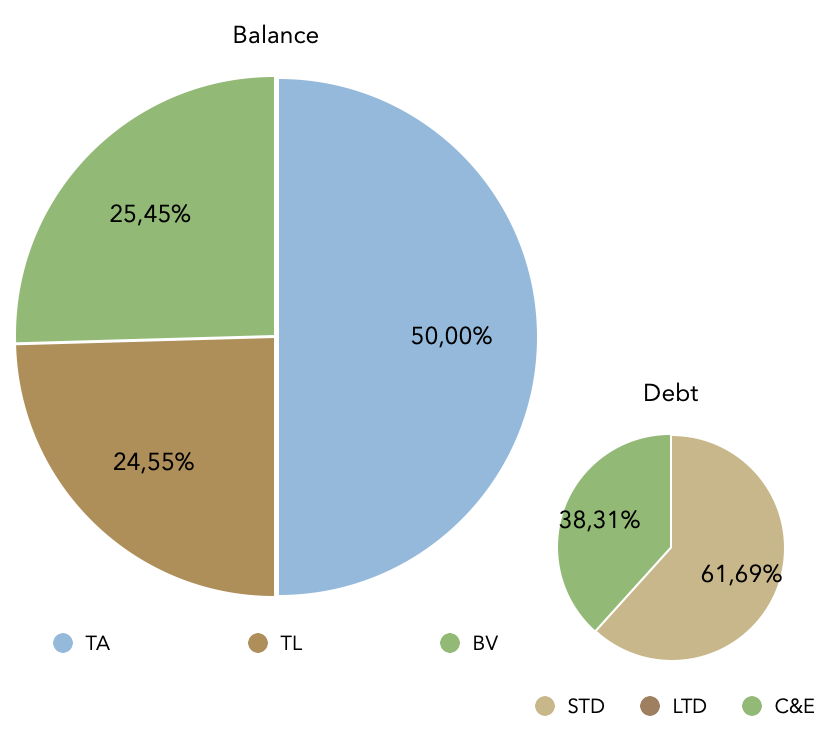

Wirtek is very conservatively managed, being almost debt free (only a small portion was accumulated after CoreBuild’s acquisition through a combination of cash, debt and share dilution).

Customer retention rates are also good: more than 60.0% of the existing customers have been clients of Wirtek for the past five years, even though it has grown at a c.29.0% CAGR over this period.

Similarly, the churn rate at Wirtek is typically below 10.0%.

Last-minute update:

In November 9 2022, Wirtek announced its Q3 FY2022 results.

Revenue growth YoY came at 21.0% (purely organic). In this quarter the company has gained three new customers which already account for c.9.0% of total sales.

The acquisition which was expected to be completed in August has been cancelled.

EBITDA margins compressed to 12.3% (from 14.5% in Q3 FY2021) due to investments made in a group-wide ERP system, required to efficiently manage the headcount growth that the company is experiencing in recent times. This should only be temporary and enable operating leverage to continue in the future, allowing Wirtek to benefit from economies of scale even further.

Revenue growth in the period Q1-Q3 compared to the same nine months the previous year was 55.0%, from which 27.0% was organic.

II. Sector.

The global IT outsourcing sector’s TAM is estimated to be around US$395 billion in 2022 and expected to grow at an 8.3% CAGR through 2027, reaching US$590 billion.

Although half of Wirtek’s sales come from Denmark (as of Q3 FY2022), the size gap between its international and local operations is closing rapidly (specially after CoreBuild’s acquisition).

Additionally, one of the operational goals of the Accelerate25XL strategy consists of opening a fifth development centre outside Romania (where the four existing ones are located).

Peers present in the Danish market are Columbus, Nnit, Nexcom or Seluxit, among others. Although all of them relate their operations to the IT outsourcing sector, some are not direct competition for Wirtek: Columbus focuses primarily on the food and beverage distribution niche, whereas Nnit targets the life sciences sector.

Nexcom and Seluxit, on their side, struggle with profitability and high indebtedness, specially the former one.

Economies of scale are one of the strongest competitive advantages a company may benefit from, particularly when they stem from the demand side (in the form of customer captivity). Wirtek is becoming one of the main players in its local market, growing profitably and beginning to enjoy the margin expansion driven once operating leverage enters the equation.

Assuming Wirtek is able to execute and meet its Accelerate25XL goals, it would be set to grow more than twice as faster its relevant market.

III. Financials.

For the last five years, Wirtek has increased revenues by 430.5% (33.9% CAGR) , with overall gross margins in the range of [60.0, 70.0]%, operating margins of c.6.0% until FY2019 and norther than 11.0% in the last two years, and NPAT margins of 10.0%, approximately.

In the last twelve months the business has generated DKK62.6M in sales, DKK7.1M in EBIT and DKK5.9M in bottom line.

Wirtek has achieved this growth without requiring external capital (net debt stands at DKK1.99M as of Q3 FY2022 as a consequence of CoreBuild’s acquisition, compared to DKK7.11M operating earnings in FY2021 alone, whereas share dilution has been around one and a half percentage points p.a. since FY2016).

This has been possible thanks to its small size in a growing sector, enabling Wirtek to deploy excess earnings in new investment opportunities at high rates of return: returns on capital employed historically amount to 60.0%-180.0% (!), with returns on equity in the range of 30.0% to 60.0% (not being a leveraged business).

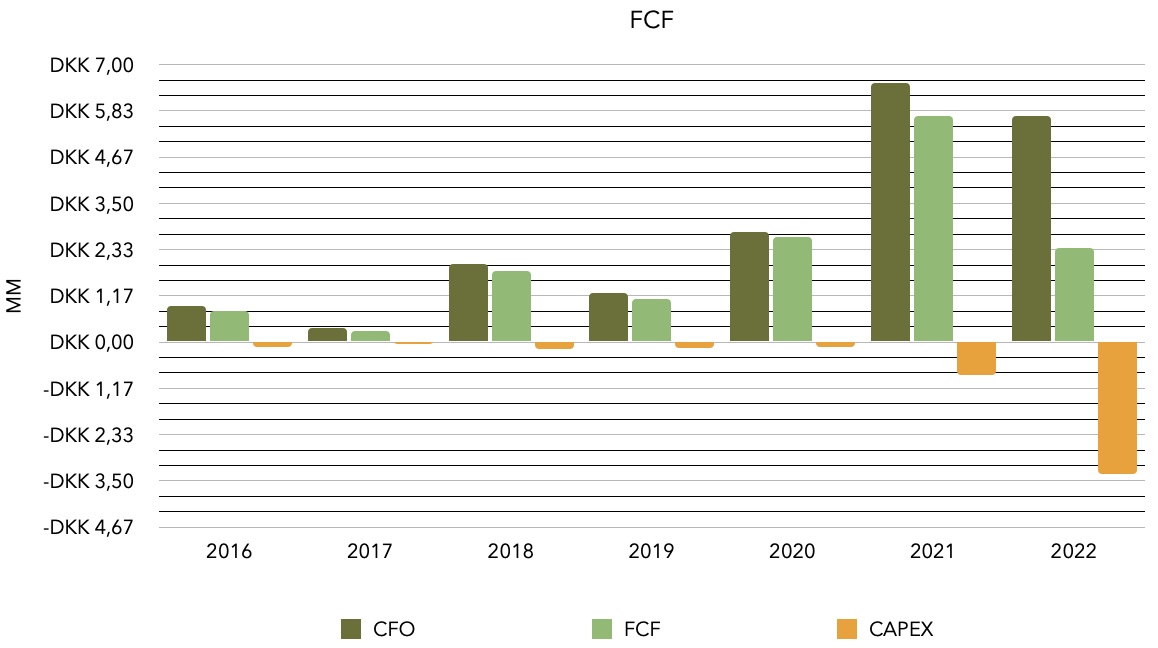

Cash from operations has recently been impacted by an increase in receivables due to the expansion in operations and customer base in new markets, primarily due to the acquisition of CoreBuild.

As the company expands its operations it continues to benefit from economies of scale, which is reflected in the increase in profitability experienced in recent years: operating margins almost doubled from c.6.0% in FY2019 to c.11.0% in Q3 FY2022.

This trend is expected to persist as Wirtek gains scale in its local and international markets.

Capital expenditures typically account for only 10.0% to 15.0% of operating cash flows, although this relationship has increased in FY2022 to c.55.0% due to the strong investment in a new ERP and inner management software system to successfully control the headcount growth (Wirtek is approaching the threshold of 200 employees).

These investments should ease by the second half of FY2023, but it is worth to be keen on them.

Wirtek is conservatively financed, with a net debt of DKK1.9M (increased from DKK(0.8)M the previous year after the acquisition of CoreBuild), with a net debt to EBIT ratio of x0.28 and an interest coverage of x11.0 times.

IV. Management.

Wirtek was founded in 2001 by Michael Aaen (current CEO and owner of 32.2% of the total pool of shares outstanding).

His story is interesting, working as a Manager at Nokia for two years before cleaving Wirtek as an independent enterprise.

The board also consists of Kent Mousten and Jens Uggerhog, who own 0.98M (12.4%) and 0.41M (6.1%) shares, respectively.

The members of the board, as a whole, hold c.52.0% of the company.

Aurora Nicoleta is the newly appointed CFO (as of Q3 FY2022) as a replacement of Emmet King, who joined Wirtek in 2013 and has stepped into the COO role.

V. Thoughts.

Qualitative analysis.

One of the most important steps for any growing micro capitalisation enterprise is to successfully manage the headcount expansion. In the last months of FY2021, Wirtek appointed a new director of human resources and administration, as well as a new CFO. These measures are focused on the implementation of a new group-wide ERP system, expecting to be completed during FY2023.

Wirtek has experience a slight positive impact derived from the unfortunate events that started in Ukraine in the first quarter of the year and have elapsed for more than six months already. New customers reached out to the company seeking to reduce operations in the affected countries and diminish risk in their activities.

Bearing in mind the high customer retention rates which characterise the company, I do not expect these new customers to vanish when the war ends.

Stronger economies of scale tend to manifest in businesses where fixed costs (wages, in Wirtek’s case) are high not only compared to variable ones, but to the relevant market which they serve, meaning that these expenses are increasingly diluted over growing sales. This generates the effect commonly known as operating leverage.

Nonetheless, as it is usual in both life and investing, nothing is always good nor bad. For economies of scale to truly result efficient in keeping competition at bay, it is desirable (paradoxically) that the market in which the incumbent company operates does not grow too fast. The reason lies in the fact that scale is only an advantage within its local area of influence, either geographically speaking or in product space.

Given the recurrence of existing customers, the low churn rate and the high insider ownership levels I believe Wirtek to be able to execute its FY2025 strategic plan and continue to grow not only profitably but maintaining its historic returns on capital beyond that date.

Points to keep an eye on.

There are some topics which I consider worth to monitor closely:

CoreBuild’s acquisition carried more than DKK9.0M, which is being depreciated at a rate of approximately DKK0.5M per year.

The implementation of a new organisation-wide ERP system to be better prepared for handling future growth of the company is eating half of the operating cash flows. This investment is expected to be completed by FY2023, but it resembles a critical point which will determine how Wirtek fares in the future.

Lastly, the aforementioned positive effect of the situation in Ukraine, although not game-changing for the company, should be monitored in case these new customers reduce their purchases from Wirtek when the war ends.

VI. Valuation.

As some of you may have already spotted, I consider valuation work an important factor before taking any investment decision, but at the same time I confess being a big fan of only making the call when the story behind the numbers is easy and understandable.

One of my personal rules is to only invest in businesses for which the required valuation work does not need any complex spreadsheet to support it.

As of November 2022, Wirtek’s share price stands at DKK14.0. With 7.46M of shares outstanding, its market cap sits around DKK106.0M (or US$15.0M).

In the last twelve months, Wirtek has generated DKK5.92M in NPAT which equates to 18 times earnings, roughly.

LTM free cash flow has fallen to DKK2.4M from DKK5.7M in FY2021, primarily driven by the strong investments in the ERP system during the year.

Nevertheless, historically the conversion rate from bottom line to free cash flow is well above 100.0%, so we should see how FCF recovers as CAPEX starts to return to previous levels at some point in FY2023.

We can establish two valuation scenarios: an optimistic one (which I also consider to be more realistic, as Michael Aaen has demonstrated his ability to execute in the past) and a second, more conservative forecast.

Let’s be optimistic.

Assuming that Wirtek delivers its strategy over the coming years and materialises the goals set in its Accelerate25XL, sales for the fiscal year 2025 would amount to DKK130.0M, with operating and NPAT margins of c.11.0% and c.9.0%, respectively.

This would entail a revenue growth rate of 25.0% p.a. for the next three years, approximately.

Considering that in order to generate that growth -either organically or by acquiring other businesses- the company increases the share issuance from 1.5% to 2.0% per year, earnings per common share outstanding in FY2025 would come at around DKK1.9 (which translates to DKK28.5/share if current market quotations remain, or a double from today’s price in the next three years).

Doomsday.

Replacing estimated growth rate by 15.0% p.a. in top line for the next three years, net profit margins by 9.0% and share dilution by 3.0% per year, EPS would come around DKK1.3/share by the end of FY2025 -a.k.a. a hurdle rate of c.5.0% assuming that the market quotation drops to 12.5 times earnings.

why don't you like about Wirtek?

Thanks for the article. Which broker do you use to trade Wirtek? I can not see it at IB.